Trading Account

Trading Account

A trading account is essential for individuals and businesses who participate in financial markets. It allows for buying and selling of securities, diversification of portfolios, and potential for profit.

Stock broking firms have thousands of clients. It is not feasible to take physical orders from every client on time. So, to make this process seamless, you open a trading account. Using this account, you can place buy or sell orders either online or by phone, which will automatically be directed to the exchange through the stock broker.

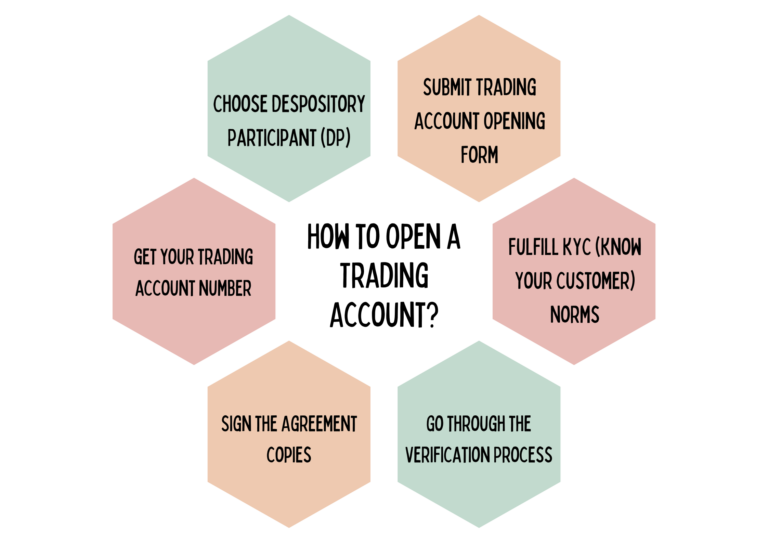

How To Open A Trading Account?

- First, select the stock broker or firm. Ensure that the broker is good and will take your orders in a timely manner.

- Compare brokerage rates, Every broker charges you a certain fee for processing your orders. Some may charge more, some less.

- Next, get in touch with the brokerage firm or broker and enquire about the trading account opening procedure. Often, the firm would send a representative to your house with the account opening form and the Know Your Client (KYC) form

- Fill these two forms up. Submit along with two documents that serve as proof of your identity and address.

- Your application will be verified either through an in-person check or on the phone, where you will be asked to divulge your personal details.

- Once processed, you will be given your trading account details.